geothermal tax credit form

Home Forums Geothermal Heat Pump Info Tax Credits Rebates and Incentives New York changes Discussion in Tax Credits Rebates and Incentives started by zach. Form 5695 is what you need to fill out to calculate your residential energy tax credits.

How To Claim The Federal Solar Investment Tax Credit Solar Sam

Taxpayers filing a claim for the Geothermal Tax Credit must submit Form IA 140 in addition to Schedule IA 148 with the individual income tax return.

. Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and in most cases hot water. There is no maximum limit on the credit which includes cost of equipment and installation. Report the tax credit claim in column D of Part I on the IA 148 Tax Credits ScheduleAny credit.

This includes the solar energy tax credit. Can we both claim the geothermal system credit Yes you can but the credit is limited to 1 500 for the installation of a geothermal system in your principal home. For qualified fuel cell property see Lines 7a and 7b later.

For those interested. You will add up your various energy credits on IRS Form 5965. Geothermal System Credit Form ENRG-A 2018.

Geothermal System Credit Form ENRG-A 2017. The renewable energy tax credit is for solar geothermal and wind energy installments and improvements. Two parts cover the two primary tax credits for residential green upgrades.

Form 5695 2021 Residential Energy Credits Department of the Treasury Internal Revenue Service Go to wwwirsgovForm5695 for instructions and the latest information. The tax credit may be used to offset AMT tax. For property placed in service after 2009 theres no limit on the credit amount.

If looking for a book Heil heat pump manual nhp in We own Heil heat pump manual nhp txt doc PDF DjVu ePub forms. The credit for geothermal machinery and equipment will be repealed on January 1 2032. New York State Energy Tax Credits.

Because they use the earths natural heat they are among the most efficient and comfortable heating and cooling technologies. Homeowners who install geothermal can get the tax credit simply by filling out a form declaring the amount you spent when you file your federal income taxes. You may be able to take a credit of 26 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property biomass fuel property and fuel cell property.

Geothermal System Credit Form ENRG-A 2016. Geothermal System Credit Form ENRG-A 2015. Its always a good idea to consult your tax.

Their justification was again NY State Tax law 606g-1 and they added PBSPublic ServiceArticle 4 66jd. Attach to Form 1040 1040-SR or 1040-NR. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income.

The IRS issues federal tax credits themselves. Of those costs on the applicable lines of one Form 5695. To qualify the geothermal heat pump must meet EnergyStar guidelines and have been installed in the home during or after FY 2009.

Form ENRG-A V1 62021 2021 Geothermal System Credit 15-32-115 MCA CLEAR FORM Name as it appears on your Montana tax return Social Security Number -. Under this resolution a tax credit of 10 of dollars spent can be claimed for geothermal heat pump systems placed in service before the end of 2016. Anyone interested in claiming this tax credit should complete a Residential Energy Credit application form and submit it to the Internal Revenue Service alongside their regular tax return forms.

A 26 federal tax credit for residential ground source heat pump installations has been extended through December 31 2022. Taxpayers filing a claim for the Geothermal Tax Credit were required to submit Form IA 140 in addition to the IA 148 with the individual income tax return. You only need to fill out the parts that are relevant to you.

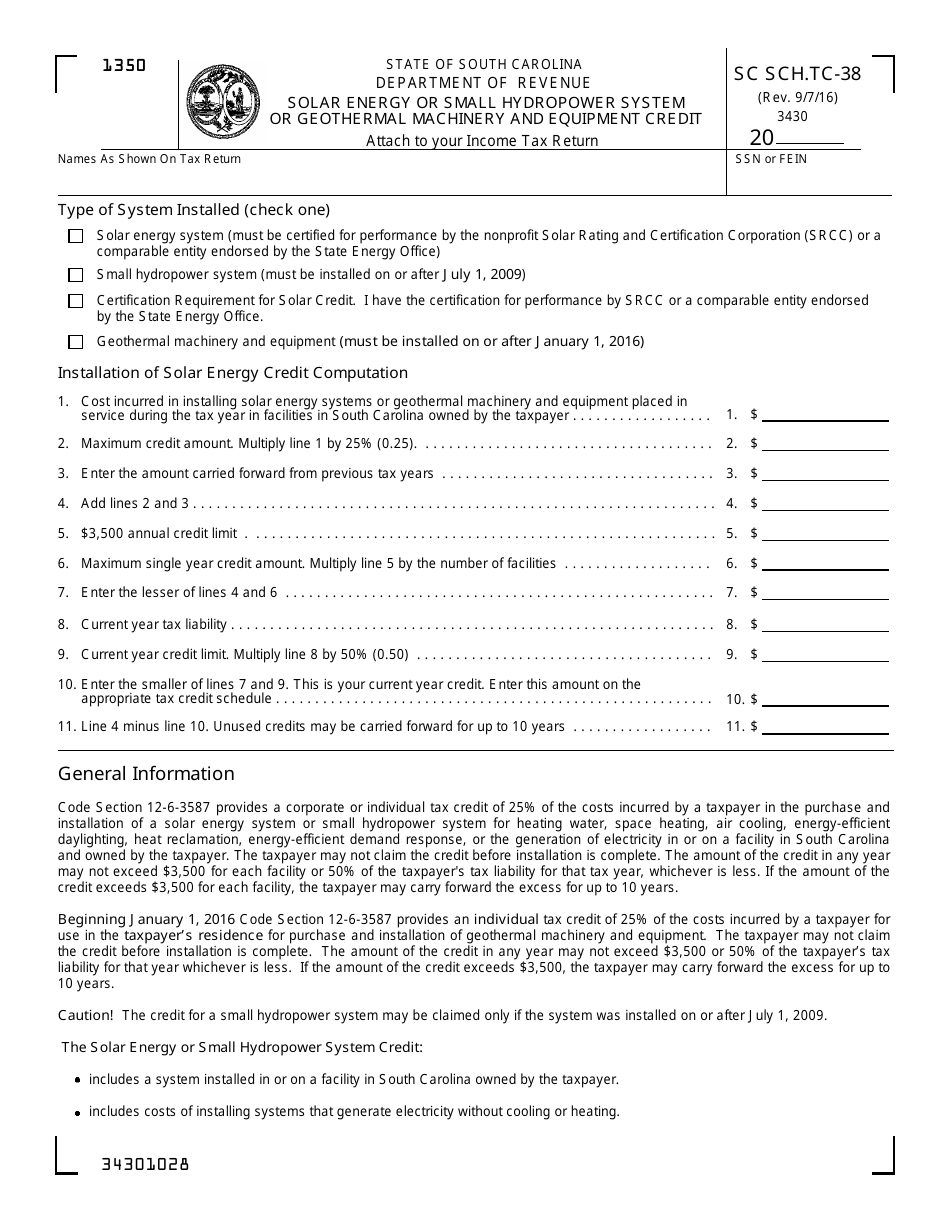

Beginning January 1 2016 an individual taxpayer who owns geothermal machinery and equipment for use in their residence may claim an Income Tax credit of 25 of the cost of purchase and installation of the machinery and equipment. US Tax Credits Through 2023. Your social security number.

Use IRS Form 5695 to claim the Residential Energy Efficient Property Credit. Geothermal System Credit Form ENRG-A 2019. Like that other credit the amount you can get back is still 30 with a decline until the tax credit expires after 2021.

The tax credit equals 10 of the taxpayers qualified expenditures on equipment that uses the ground or groundwater as a thermal energy source to heat the taxpayers dwelling or as a thermal energy sink to cool the dwelling. An update on my ongoing case to claim solar tax credit for New York state. The incentive will be lowered to 22 for systems that are installed in 2023 so.

You need to submit it alongside Form 1040. When submitting a tax return file Form 5695 under Residential Energy Credits to get credit for your geothermal heat pump. The tax credit can be used to offset both regular income taxes and alternative minimum taxes AMT.

Report any Geothermal Tax Credit first reported on the 2017 IA 140 and unused in tax year 2017 reported in column H of the 2017 IA 148. The energy tax credit can be combined with solar and wind credits as well as energy efficiency upgrade credits. This includes labor onsite preparation equipment assembly and the necessary piping and wiring used when connecting the system to the home.

You can claim the credit for your primary residence vacation home and for either an existing structure or new construction. The Geothermal Tax Credit filed through form 5695 covers expenses associated with the installation of ground source heat pumps. In excess of the tax liability for the tax year may be credited to the tax liability for the following.

How to Claim the Credit. I just received the 2nd denial notification for my solar energy tax credit regarding the installation of my geothermal heat pup system. As long as your system is up and running by the end of 2022 you can.

The Geothermal Tax Credit was available for installations beginning on or after January 1 2017 through December 31 2018. Names shown on return. New York offers state solar tax credits capped at 5000.

In order to qualify for this tax credit You can file for the credit by completing form 5695 Geothermal heat pumps and the renewable heat exchangers in the.

Tax Credits And Other Incentives For Geothermal Systems Waterfurnace

How To Claim The Solar Tax Credit Itc Irs Form 5695 Forme Solar

Form Sc Sch Tc 38 Schedule Tc 38 Download Printable Pdf Or Fill Online Solar Energy Or Small Hydropower System Or Geothermal Machinery And Equipment Credit South Carolina Templateroller

Irs Form 5695 Lines 1 4 Irs Forms Irs Tax Credits

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current

Form 5695 Claiming Residential Energy Credits

26 Solar Federal Tax Credit Own It Solar

Form 5695 For 2021 2022 Energy Tax Credits

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current

The Federal Geothermal Tax Credit Your Questions Answered

Instructions For Filling Out Irs Form 5695 Everlight Solar

Geothermal Heating Cooling Archives Earth River Geothermal Inc

Steps To Complete Irs Form 5695 Lovetoknow

Geothermal Tax Credit Geothermal Heating And Cooling Review

Energy Efficiency Tax Rebates Solar Energy Companies Energy Efficiency Solar Energy Diy