san francisco gross receipts tax pay online

The fiscal year for the City and County of San Francisco starts on July 1 and ends on June 30. Seven 7 digit Business Account Number.

How To Self Clear Customs For Ups Shipment Commercial Invoice Invoice Template Invoice Template Word Invoice Layout

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

. Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment Portal. Beginning in 2014 the calculation of the SF Payroll Tax changes in two significant ways. There are seven different tax rates based on different business activities see below for a summary of the business activity categories.

San Francisco Online Bill Payment. Box 7425 San Francisco CA 94120-7425. File Annual Business Tax Returns 2021 Instructions.

Request a PIN Reset To Pay by Mail. City and County of San Francisco 2000-2020. 2020 Annual Business Tax Returns.

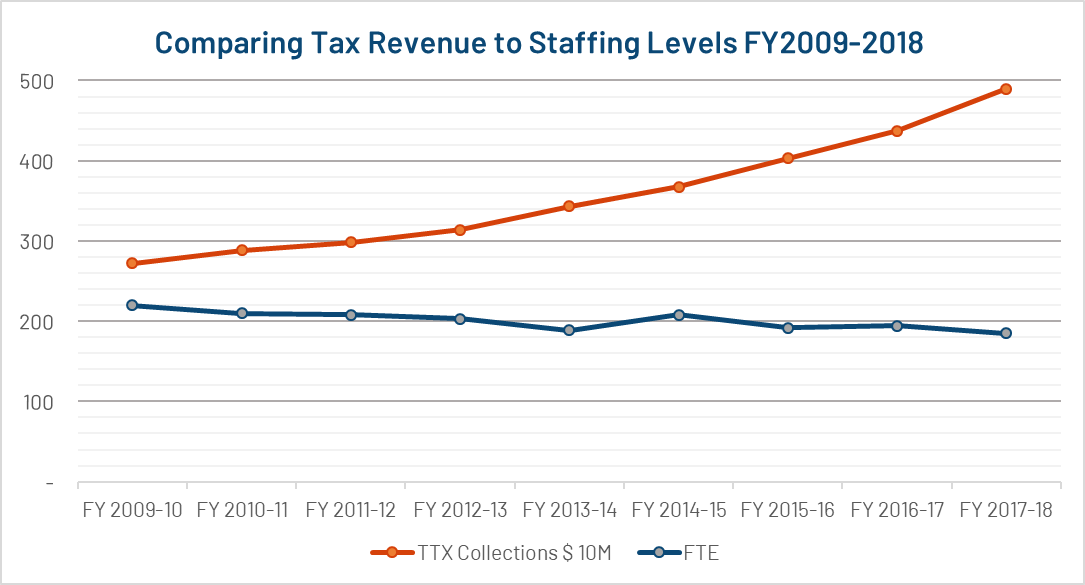

All groups and messages. For tax year 2017 the gross receipts tax rates range from. The most recent tax rates can be found on the TTX website.

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. A fiscal tax year is 12 consecutive months ending on the last day of any month except December. Lean more on how to submit these installments online to comply with the Citys business and tax regulation.

The City of San Francisco passed The Gross Receipts Tax and Business Registration Fees Ordinance ie Proposition E on November 6 2012. Under the new regulations a new gross receipts tax will be phased in while. San Francisco Tax Collector PO.

Breed said The City will allow qualifying small businesses to defer payment to the tax collector on their next round of quarterly taxes due April 30. 1 the tax begins its transition to the gross receipts tax so there is a declining payroll tax component. Hotels parking or business personal property.

Remit your payment and remittance detail to. The Business Tax and Fee Payment Portal provides a summary of unpaid tax license and fee obligations. Gross receipts refers to the total amount of money received from doing business in San Francisco and includes amounts derived from sales services dealings in property interest rent royalties dividends.

Some businesses may be required to pay additional taxes based on their business type eg. The calendar tax year is 12 consecutive months beginning January 1 and ending December 31. Make a payment Please note the following.

The Business Tax and Fee Payment Portal provides a summary of unpaid tax license and fee obligations. 2021 Annual Business Tax Returns. Please enter your new password must be at least 6 characters long and contain 1 uppercase letter 1 lowercase letter and 1 number.

Q3 Estimated SF Gross Receipts Tax installment payment. Most business taxes require you to file your tax return before you will see an obligation in the payment portal. Deadline to pay first installment of property tax bill to San Francisco County.

Eight 8 character Online PIN. The gross receipts tax rates vary depending on the type of business and the annual gross receipts from business activity in the city. Greater than 3001 a 03 overpaid executive tax rate.

Taxpayers should not consider these instructions as authoritative law. City and County of San Francisco 2000-2021. San Francisco PayrollGross Receipts Tax Changes.

The San Francisco Annual Business Tax Online Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. You may file your gross receipts and payroll expense taxes online with TTX. Businesses with operations in San Francisco are now subject to a new tax and registration structure.

Last four 4 digits of your business Tax Identification Number Federal EIN or SSN. Gross Receipts Tax Rates. For example an entity with an executive pay ratio of greater than 2001 would pay a 02 overpaid executive tax rate.

If the executive pay ratio exceeds 1001 then an additional tax will be imposed on apportioned San Francisco gross receipts ranging from 01 to 06 depending on the computed executive pay ratio. File the CA Franchise Tax due with Form 100 if extended. Delaware Quarterly Estimated Franchise Tax Pay 20 of estimated annual amount if annual amount expected to exceed 5000.

To avoid late penaltiesfees the returns must be submitted and paid o n or before February 28 2022. You may pay online through this portal or you may print a stub and mail it with. The San Francisco Business and Tax Regulations Code Code provides the law for computation and rules for filing the Return.

Gross Receipts Tax and Payroll Expense Tax. The new Gross Receipts Tax and Business Registration Fees Ordinance which went into effect in 2014 is a significant change to the method in which payroll taxes are calculated and remitted to the city. You may pay online through this portal or you may print a stub and mail it with your payment.

San Francisco taxes businesses based on gross receipts and payroll as well as business personal property like machinery equipment or fixtures. Business Tax and Fee Payment Portal.

Property Tax Search Taxsys San Francisco Treasurer Tax Collector

Annual Report Fiscal Year 2018 19 Treasurer Tax Collector

Accounting Importance Of Time Management Online Education Accounting Programs

Property Tax Search Taxsys San Francisco Treasurer Tax Collector

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gusto Offers Fully Integrated Online Hr Services Payroll Benefits And Everything Else Payroll Payroll Software Accounting Services

How Do I Print My Employees Paychecks Payroll Checks Payroll Business Checks

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

Indinero Accounting Taxes Payroll Software For Businesses Payroll Software Accounting Services Accounting

Usa San Francisco Chime Bank Statement Template In Word Format Statement Template Bank Statement Credit Card Statement

Service Invoice Template With Calculated Tax Amount Based On The Given Tax Rate Freelance Invoice Template Invoice Template Word Invoice Template

Key Dates Deadlines Sf Business Portal

Free Mobile Car Wash Invoice Template Google Docs Google Sheets Illustrator Indesign Psd Template Net Invoice Template Template Google Car Wash

Contribution Card Template Guatemalago In Organ Donor Card Template Cumed Org Student Business Cards Card Template Free Business Card Templates

Job Description Candidate Should Have Good Exposure On General Accounts Like Day To Day Entries Taxatio Being A Landlord Job Search Websites Tenant Screening

Ventura Cpa Bill Soderstedt Furniture Storage Decor

Annual Business Tax Returns 2021 Treasurer Tax Collector

Are You Planning To Hire An Accountant For Your Startup Or Small Business Accounting Services Small Business Start Up Start Up Business